AdGooroo recently shared a report that highlighted the data of paid search advertising performance in retail category from Q4 2015 and how it may impact the upcoming holiday season this year.

Here are some key inputs from the report that might put an end to some of the speculations for the peak season.

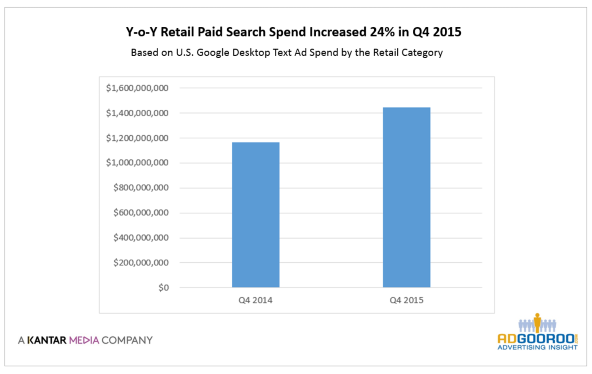

Paid search spend likely to increase in Q4 2016

While Q4 2015 witnessed an increase of 24% in the ad spend by retail advertisers the same is expected to happen in Q4 2016 too. With the spend having already increased by 32% from January till August, 2016 (compared to the same time period in 2015), the trend is most likely to continue.

Geo Targeting option may stay at the top-of-mind for advertisers

Top retail keyword data from January to April 2016 suggests that the CPC for some keywords may vary by city. Knowing so, advertisers might wish to opt for geo targeting to save their cost and increase their revenue. Retailers can diagnose basis other metrics and decide where to allocate more budget, preferably to cities with lower CPC and exclude the ones deemed unprofitable. Similarly for keywords with higher CPC in cities in comparison to national level, advertisers can opt to run national campaign over the local campaigns.

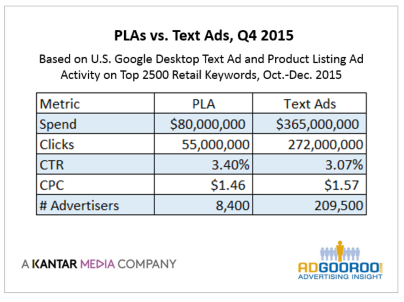

Sizeable difference between PLAs and Text Ads

Basis data of previous years it was observed that 85% fewer advertisers were sponsoring for PLAs than text ads for the top retail keywords from March to August in 2015.

In Q4 2015, 95% fewer sponsors for PLA vs text ads, which has further decreased to 77%fewer PLA sponsors vs text ad advertisers.

Impact of removal of paid search text ads from right rail

Since Google took the option away, on comparing the performance metrics post the change with the previous year suggested that the number of advertisers bidding on top 2500 keywords dropped by 64%. This implies that the holiday season too might witness fewer advertisers but an increase in competition resulting in rising CPCs to fight for the top slot. The CPC rose 8% from $1.37 (March-Aug, 2015) to $1.48 for the same time period this year. Though the advertisers might have reduced, the CTRs have been observed to increase by 15% post right rail period (March-August).

Other highlights of the report are:

- Apparel and Consumer Electronics categories witnessed increase in CPC and competition in Q4, 2015

- Black Friday and Cyber Monday were the top grossing keywords in Q4, 2015 and retailers must considering sponsoring this keyword

- PLA spend on top 2500 keywords was 78% less than the amount spent by advertisers for text ads

For more detailed insights, download the report from here.

Related Articles:

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.