On July 11, 2025, the UK Competition and Markets Authority (CMA) published a set of documents evaluating competition in core markets like search engines and housebuilding. These include the Proposed Decision, and supporting annexes on Market Outcomes and Profitability Analysis.

Below are the major findings from these documents,

TL;DR:

The UK’s Competition and Markets Authority (CMA) has flagged serious concerns about Google and Meta’s dominance in the digital advertising market. Together, they control over 80% of ad spend in search and social, making it harder for rivals to compete and for advertisers to get fair pricing or transparent data. The CMA’s findings raise big questions about fairness, competition, and the future of digital marketing.

Is Google Too Dominant in Search?

Yes. The CMA finds that Google holds entrenched, strategic market power in the UK search market and proposes designating it as a Strategic Market Status (SMS) firm.

(SMS stands for Strategic Market Status. It refers to a legal designation under the UK’s Digital Markets, Competition and Consumers Bill for firms that have substantial and entrenched market power and a position of strategic significance in a digital activity in the UK. If a firm (like Google or Meta) is designated with SMS, it becomes subject to stricter conduct requirements to promote fair competition and prevent abusive behavior.)

Key Findings:

- Dominant Presence Across Platforms

- Google commands more than 90% of the UK’s general search traffic, firmly establishing itself as the primary gateway to online discovery.

- Mobile Supremacy

- On mobile devices, Google’s grip is even tighter — capturing up to 97% of mobile search queries during peak periods. This mobile-first dominance is reshaping how users access information and how advertisers reach them.

- High Barriers for New Entrants

- Competing search engines face formidable challenges, from Google’s powerful distribution partnerships and vast data reserves to its economies of scale in search ad monetization. These factors make market disruption extremely difficult.

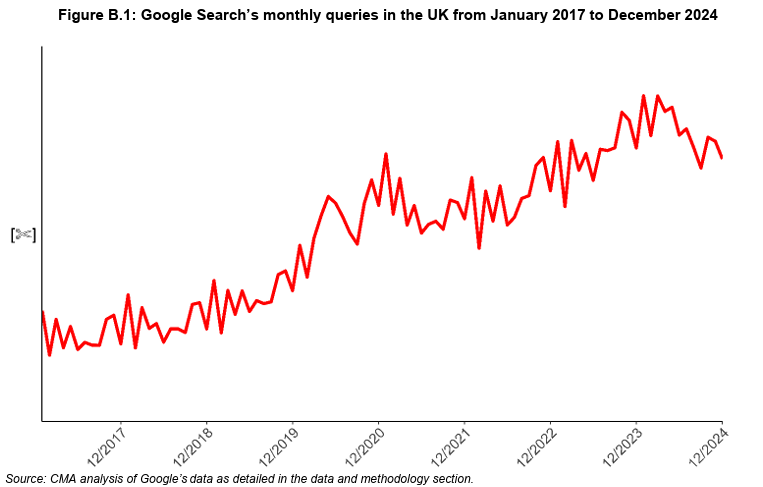

The following graph shows a steep rise in monthly UK search queries on Google from 2017 to 2024 — a growth of nearly 60%. This underscores the platform’s increasing centrality in user behavior

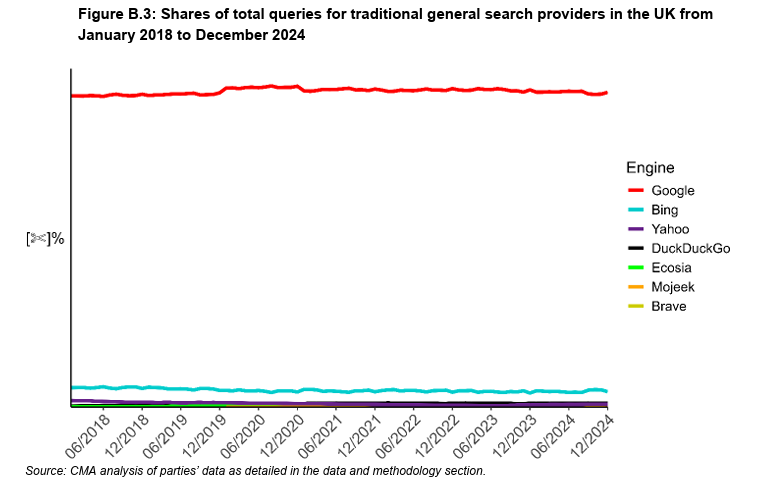

Looking at the below graph, its revealed that Google’s mobile search share reaching 97% during peak periods — underscoring its dominance on mobile devices.

“Google’s share of mobile general search queries is even higher, reaching 97% during certain periods.” — CMA Proposed Decision

The CMA concludes:

“Google possesses substantial and entrenched market power and a position of strategic significance in general search services in the UK.”

What’s next?

A public consultation is underway. A final SMS designation decision is expected by October 2025, allowing for conduct requirements and other interventions.

Profits Without Pressure: Why Google’s Margins Matter?

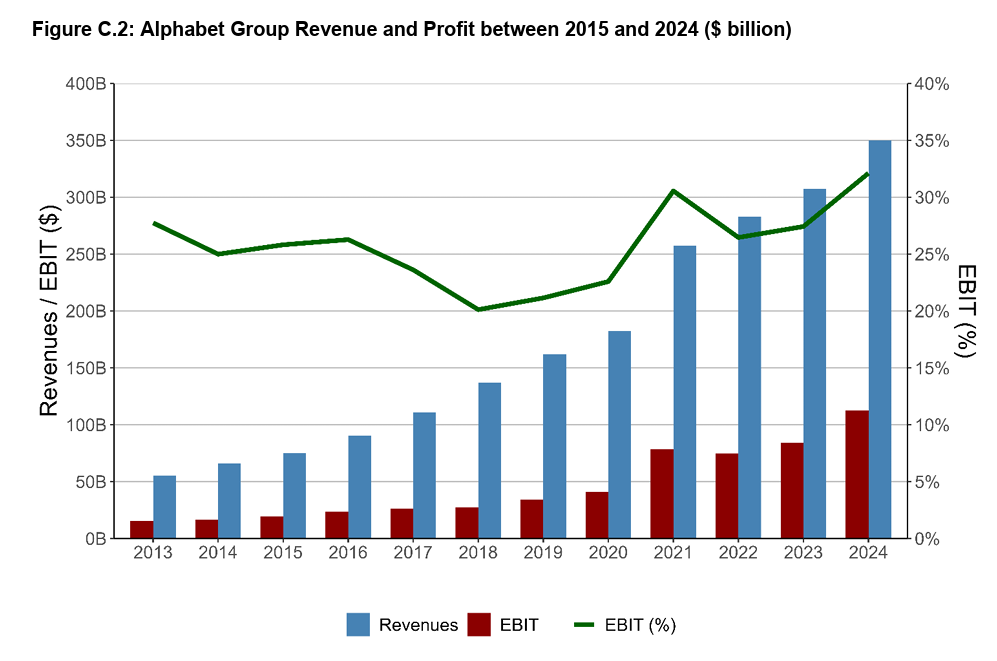

The below graph shows Google’s revenue and operating profit (EBIT) from search services between 2022 and 2024 — both consistently high. Based on these, the CMA estimates Google earns over 40% return on the capital it invests in search.

“Our estimate of Google’s return on capital from its general search services… is higher than 40%, using a sensitivity-based analysis.” – Annex C, para C.6

This return is well above Google’s cost of capital, which the CMA estimates at 10–15%. In plain terms: Google doesn’t just profit — it profits without competitive pressure.

Barriers to Entry: Why Rivals Struggle?

“Barriers that competitors face … include Google’s distribution agreements, data advantages and scale in search advertising.” — CMA Proposed Decision

Google’s default placement on browsers and devices (via deals with Apple, Samsung, etc.), massive data advantage that fuels better ad targeting, and Ad tech scale, outperforms smaller players, making it difficult for alternatives to gain visibility, no matter how innovative or differentiated they are.

Can AI Assistants Compete with Google?

Not yet. Despite the rise of generative AI, the CMA sees no material challenge to Google from tools like ChatGPT, Gemini, or Perplexity.

“Use of AI assistants is currently very low when compared to Google’s general search products… Google is also well‑positioned to ensure that AI assistants do not develop into a more sustained and significant competitive constraint.” – CMA Proposed Decision

Takeaway: Google’s market position is unlikely to be eroded by AI in the next 3–5 years. Despite the rise of ChatGPT, Gemini, and Perplexity, the CMA finds that AI tools are not yet disrupting Google’s dominance in search.

Is Meta Still Dominating Social Media?

“Meta accounted for over 70% of user time spent on social media platforms in the UK.”

Key Highlights:

- Meta’s platforms (Facebook, Instagram) remain the primary gateways for social engagement and display advertising.

- New entrants haven’t changed the landscape: “The overall pattern of market outcomes remains stable despite new platform launches.”

- TikTok is growing, but ad spend and overall time spent still trail Meta significantly.

Implication: Meta remains the primary gatekeeper for social engagement and display advertising.

What Does This Mean for Digital Marketers?

- Expect more scrutiny on ad tech ecosystems, particularly search and display advertising.

- Google may face new limitations on bundling, data collection, and ad auction behavior.

- Meta’s dominance may invite future interventions aimed at creating space for emerging platforms.

- Diversification will be key — brands should explore alternative channels while monitoring how regulation evolves.

Additional Key Findings

- Opaque Ad Auctions: Advertisers lack visibility into how Google ranks and prices bids — a concern flagged by the CMA.

- Data Access Asymmetry: Google and Meta’s vast data ecosystems give them a competitive edge in targeting and attribution.

- Stable Market Outcomes: Even with new platforms, Google and Meta’s dominance remains structurally intact.

What’s the CMA Planning to Do About It?

For Google:

- Finalize SMS designation by October 2025

- Follow with potential conduct requirements or pro-competition interventions

For Social & Digital Ads:

- Continue investigations under the Digital Markets Unit (DMU) framework

- Explore remedies to reduce barriers for smaller platforms and advertisers

Final Thought

The CMA’s findings make it clear:

Digital advertising is no longer a level playing field.

With Google and Meta holding near-total control of key user pathways, marketers must be aware not just of platform performance — but also of the regulatory winds that may reshape the future of search and social.

Is Google too powerful for its own good? Or do its profits reflect user value?

Drop your thoughts in the comments — let’s unpack what real competition in search might look like.

Source Documents:

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.