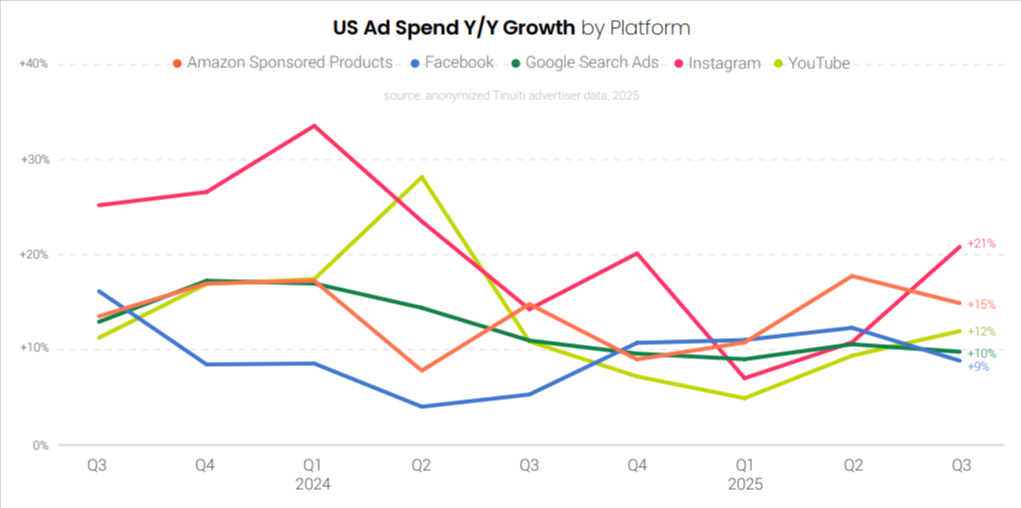

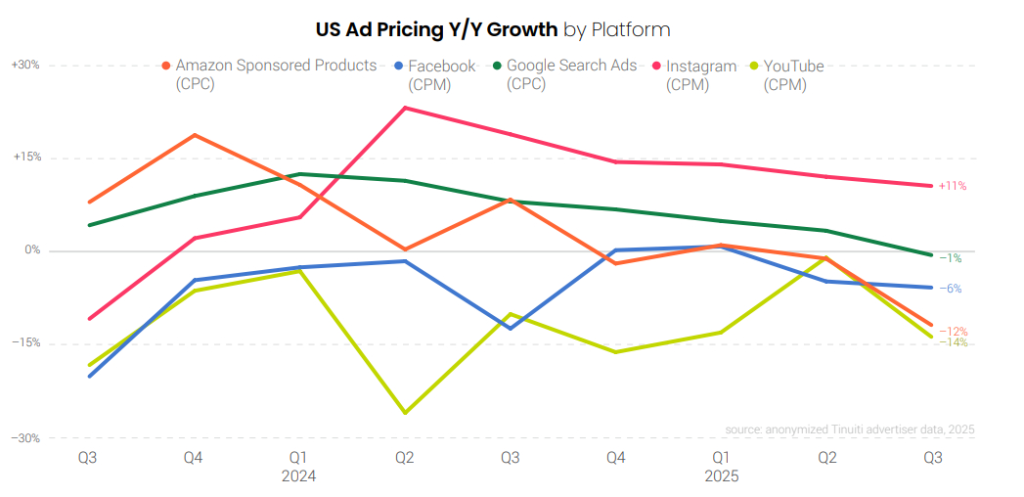

Tinuiti’s Q3 report showed a compelling mix of volume growth and softening ad prices. Impressions and clicks surged across major platforms, even as CPCs and CPMs moderated, signalling an increasingly competitive but efficient ecosystem for advertisers.

To read the complete report, download it here.

Overall Trends: Despite Softer CPCs, Ad Spend Hits New Highs

With ad prices dropping and reach expanding, advertisers now have a great chance to drive more traffic at a lower cost

Even though pricing growth slowed, ad spend continues to climb across Google, YouTube, Instagram and Amazon Sponsored Products.

Regarding CPC and CPM trends, Google search CPC decreased by 1%, Facebook CPM dropped by 6%, and YouTube CPM declined by 14%. Clicks and impressions surged. Google Search clicks up 11%, Amazon Sponsored Products clicks up 31%, and Instagram impressions up 9%.

For many Google advertisers, Amazon’s withdrawal from U.S. Google Shopping auctions in late July likely drove stronger click growth and softer cost-per-click trends, as the e-commerce giant’s exit left a significant gap for competitors to fill.

Despite Amazon’s absence from Google Shopping auctions, Sponsored Products continued to grow—clicks jumped 31% year over year, while spend rose 15%. With Amazon off Google’s listings, more shoppers may be starting their search directly on Amazon.

Sponsored Products ads performed strongly for Walmart in Q3, with ad spend rising 48% year over year. Unlike many other formats facing softer pricing growth, Walmart’s Sponsored Products saw average CPCs climb 23% year over year.

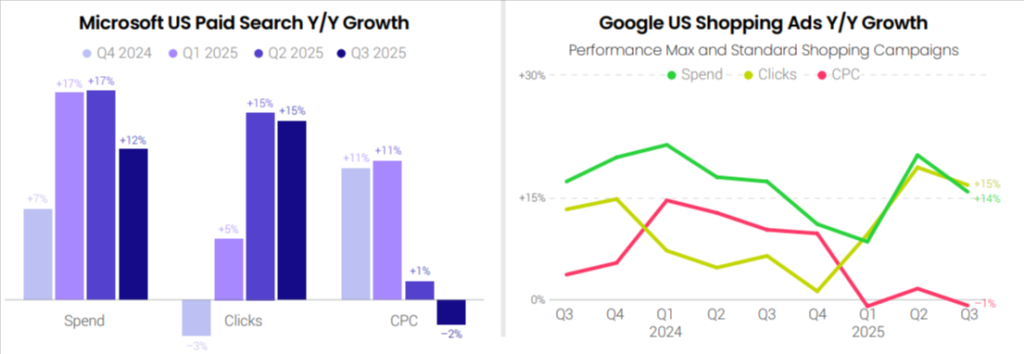

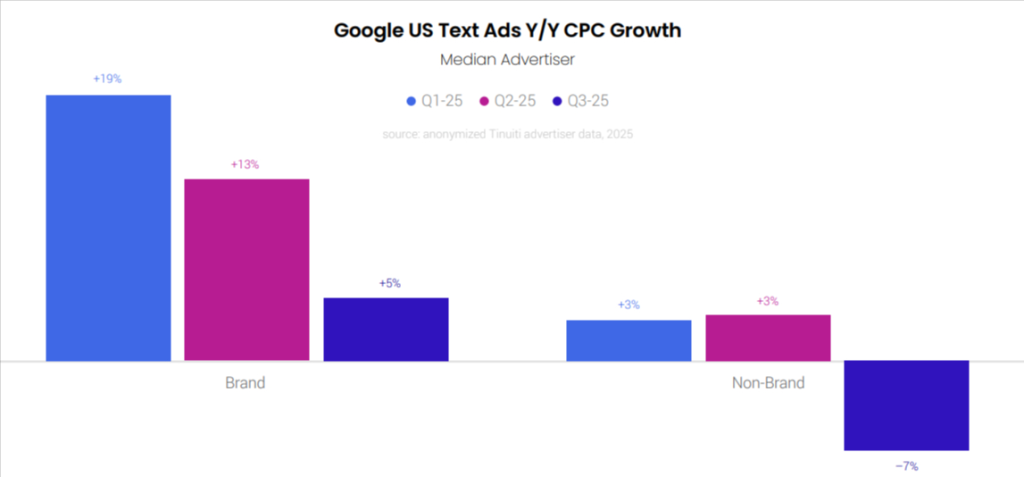

Paid Search Finds Its Balance: Rising Engagement, Falling CPCs

Search remains a reliable performer, as rising click volumes and lower CPCs open up a cost-efficient opportunity for advertisers to grow

Paid Search results were shaped largely by Amazon’s exit from U.S. Google Shopping auctions in late July. This departure left a sizable gap in the marketplace, prompting competitors to quickly step in. This resulted in stronger click growth for many Google advertisers, but softer CPC trends overall.

- Google paid search ads were up 10%, click growth reached 11% but average CPC was down 1%.

- Google shopping ad spending was up 14%, clicks grew 15% and CPCs fell 1%.

- Microsoft paid search ads were up 12%. Click growth for Microsoft search ads – including text, shopping, and Performance Max campaigns – was down slightly to just under 15% and CPCs were down 2%.

- Performance Max accounted for 68% of Google Shopping spend, generating slightly higher conversions (+2%) but 2% lower ROAS than standard Shopping campaigns.

After a sharp 19% year-over-year rise in Q1 2025, CPC growth for advertiser brand keywords has eased considerably, climbing just 5% in Q3. On the non-brand front, CPCs saw a mild 3% uptick early in the year and held steady through Q2 — but by Q3, they had dropped 7%. Although Amazon has exited Google Shopping listings in the U.S., it continues to hold a strong footing in text ads.

Paid Social Reignited: The Big Three Make Their Moves

Meta and Pinterest lead growth, while TikTok and Snapchat’s stability reflects renewed advertiser confidence in a balanced social mix

Social platforms showed mixed performance, strong growth for Meta and Pinterest, stabilisation for TikTok, and sustained momentum for Snapchat and Reddit.

- Meta ad spend rose 14% in Q3, with impressions up 16%, the strongest since Q4 2023, while CPM slipped 2%.

- Facebook Ad impressions rose 15% year over year, driving a 9% increase in spend even as CPM fell 6%.

- Instagram ad spend rose 21% year over year, with CPM up double digits for the sixth straight quarter and impressions up 9%.

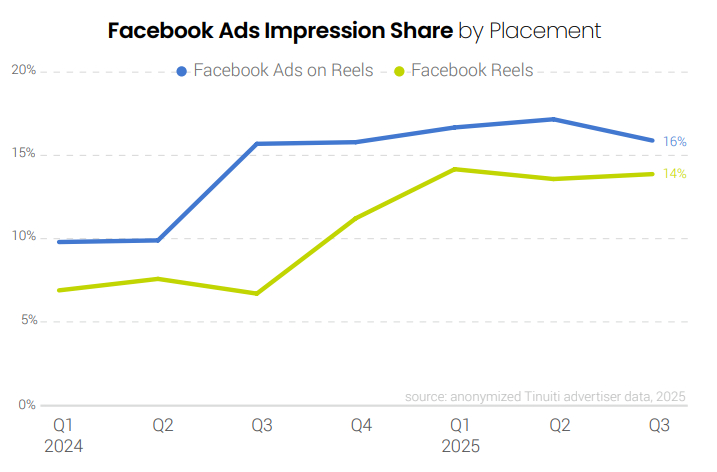

- Reels inventory continues to expand — now 26% of Instagram impressions and 14% on Facebook.

- Advantage+ shopping campaigns saw a decline, dropping to 27% in Q3 after making up 35% in Q2 and 38% in Q1.

The share of Facebook ad impressions coming from Reels video ads has doubled — climbing from 7% in Q3 2024 to 14% in Q3 2025. Reels ads, previously called Reels Overlay ads, now make up 16% of total impressions.

Pinterest ad investment surged 63% year over year in Q3, fueled largely by a 52% jump in impressions. CPMs rose more modestly, up just 7% from the same period last year. Reddit advertising spend jumped 40% year over year in the third quarter — following gains of 33% in Q1 and 55% in Q2 — as more advertisers ramp up their investment to connect with Reddit’s highly engaged audience.

Commerce Media Sees Explosive Growth: Click Volume Rockets for Sponsored Products

Commerce media is growing fast — Walmart nears Amazon’s ad efficiency, while Amazon’s DSP gains momentum from rising Prime Video demand

Retail media continued its sharp ascent, with Amazon and Walmart both recording strong double-digit growth.

- Amazon Sponsored Products advertisers saw click growth 31%, spend 15% and CPC fell 12%.

- Amazon Sponsored Brands spend growth ads 3% year over year in Q3, with a 13% decline in clicks,

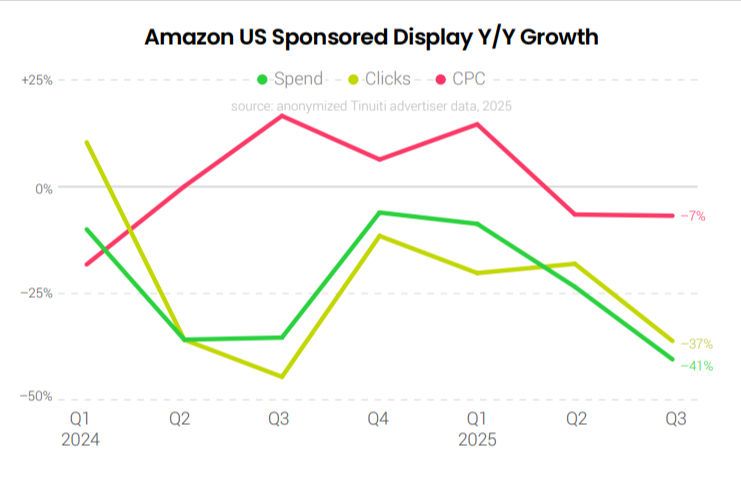

accompanied by an 18% increase in CPC - Amazon Sponsored Display spend fell 41%, a 37% decline in clicks and 7% decline in CPC

- Fully 39% of all Amazon spend was attributed to the DSP in Q3. Investment in the Amazon DSP rose

21%, Average CPM increased 11% and impressions rose 9%

With regards to Walmart :

- Sponsored Products advertisers saw 48% spend growth. Clicks and CPC grew 23% and 21% respectively.

- ROAS rose up to 10% year over year

- Sponsored Products account for 88% of Walmart search spend

- Self-serve display represents 34% of self-serve spend, with 66% going to search formats.

In Q3, Sponsored Brands ads were 32% costlier than Sponsored Products, down from 43% in Q2. Sponsored Video CPCs also dropped, from 16% higher in Q2 to 11% in Q3. This trend follows Walmart’s decision in November 2024 to lower the minimum bid for Sponsored Videos from $1.30 to $0.80, which has steadily helped narrow the CPC gap between ad types.

Video and Display: TV Screens Drive YouTube and Demand Gen

CTV and video continue to grow as cross-channel powerhouses, with lower CPMs and rising impressions improving efficiency for video-first advertisers

Video remains a centrepiece of brand and performance campaigns, driven by YouTube’s evolving ad formats and streaming’s steady adoption.

- YouTube video ad spending was up 12%. While YouTube CPMs fell 14% year over year in Q3, impression growth improved to 30%.

- YouTube Shorts ads accounted for 23% of segmented YouTube video ad spending (TV screens = 50% of Shorts spend)

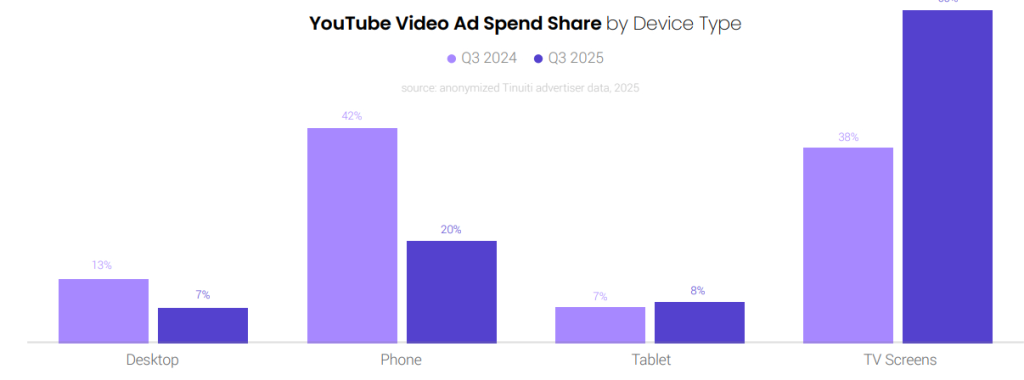

- TV devices now account for 65% of YouTube ad spend (up from 38% YoY)

- Spending growth for Demand Gen campaigns was up 26% year over year. Impressions were up 24%, while average CPM was up 2%

Google Display Network (GDN) spending rose 4% YoY in Q3 2025, down from 6% growth last quarter. Impressions increased 7%, while CPMs fell 3%. Google’s “Other” ad revenue, excluding Search and YouTube, has now seen single-digit declines for 12 straight quarters.

In Q3, mobile devices — both phones and tablets — made up 26% of traditional streaming ad spend, while computers added another 11%. When it came to RTB-purchased streaming ads, mobile and desktop together played an even bigger part, accounting for just over half of the total spending.

Once again, click here to download the complete report.

Related Links

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.