Tinuiti’s Q4 report revealed a strong blend of rising volumes and easing ad costs. Impressions and clicks climbed across major platforms, while CPCs and CPMs cooled, pointing to a more competitive yet increasingly efficient environment for advertisers.

To read the complete report, download it here.

Overall Trends: High Demand and Falling Prices Set the Stage for Q4 Growth

Ad spend accelerated on Google Search, YouTube, and Amazon Sponsored Products, while Facebook and Instagram saw slower growth than in Q3

YouTube remained a key Q4 channel, with most retailers shifting their YouTube spend to Google Demand Gen after the July transition. Video now accounts for 66% of Demand Gen spend in Q4 2025, up sharply from 28% a year ago.

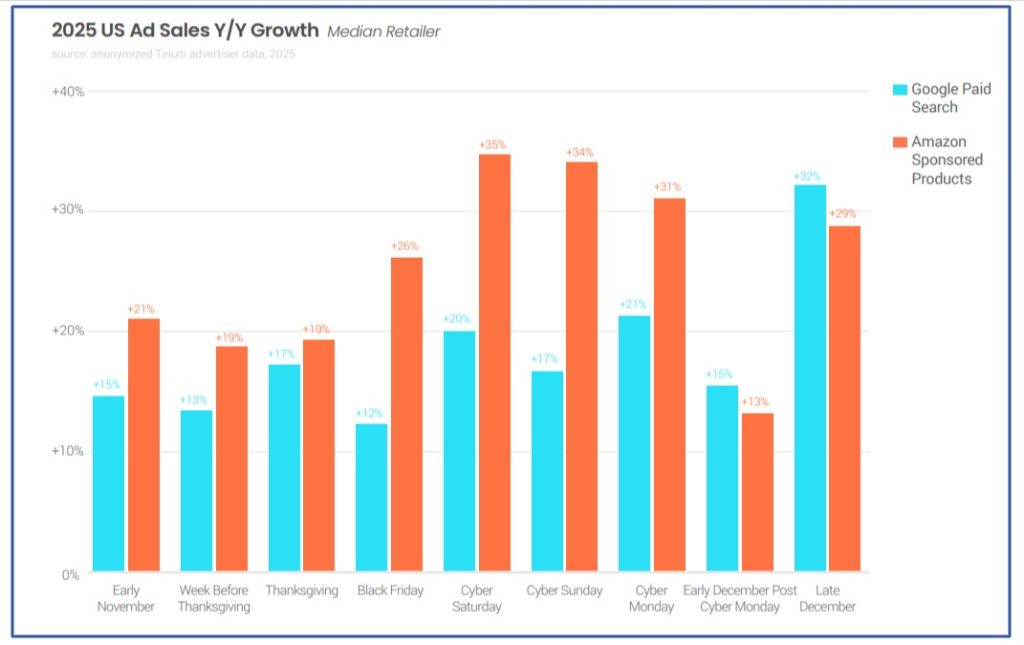

Amazon Sponsored Products delivered stronger holiday-season growth than Google paid search across most of Q4, though retailers saw solid results from both channels in the second half of the quarter.

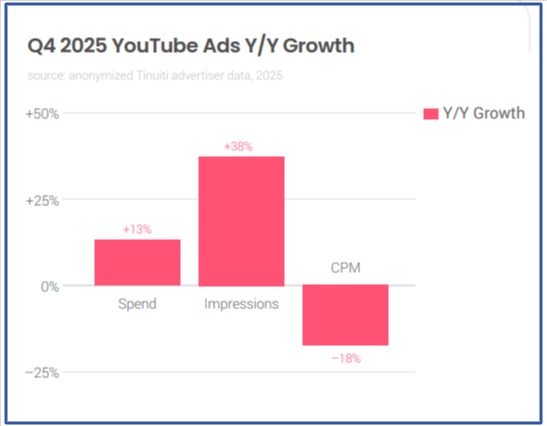

Clicks and impressions surged across platforms, even as pricing growth weakened—Google Search CPC fell 1%, Facebook CPM dropped 13%, and YouTube CPM declined 18%.

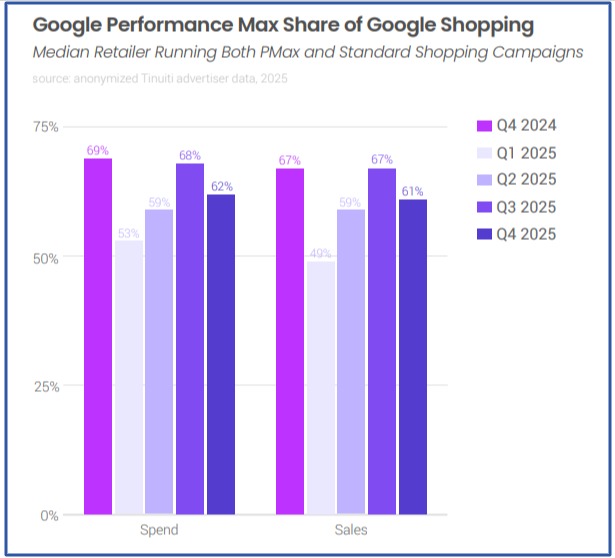

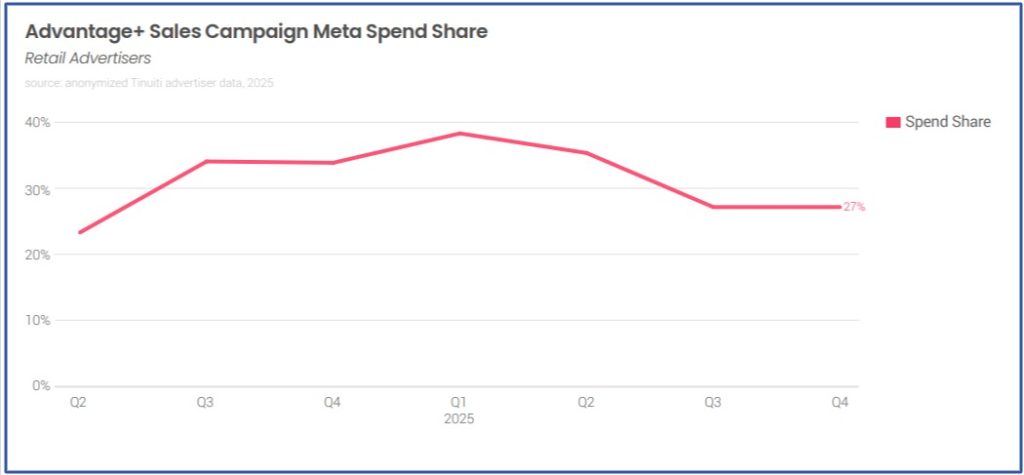

Reddit, Pinterest, and TikTok are embracing AI-driven campaigns, following Google and Meta, where AI already plays a major role. In Q4, Google’s Performance Max drove 62% of retailer spend on Shopping ads, while Meta’s Advantage+ accounted for 27% of retail spend on Meta.

Paid Search: Click Growth Near Five-Year Highs as CPCs Stay Muted

Google Search ad spend and clicks grew 13% YoY in Q4 2025, aided by Amazon’s absence, while CPCs stayed soft.

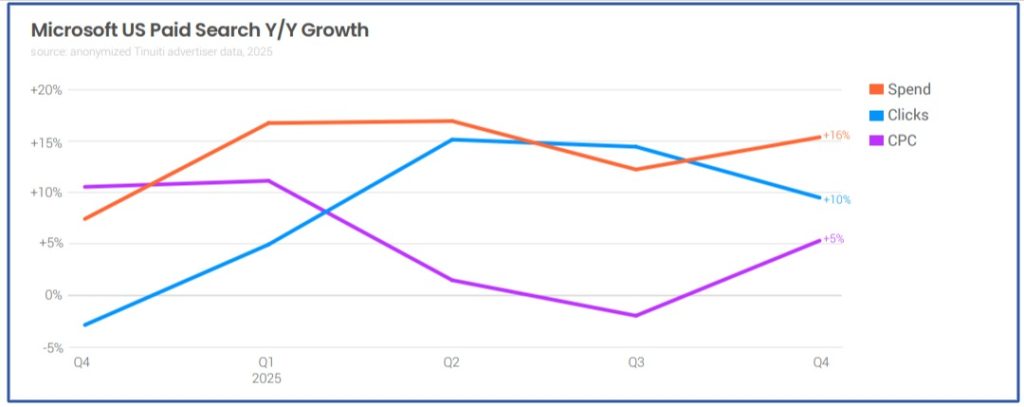

Advertisers’ spend on Microsoft paid search grew 16% year over year in Q4 2025, beating Google and accelerating from the prior quarter. Click growth slowed to 10%, but CPCs rebounded, rising 5% after declining in Q3. Amazon also continued to appear in Microsoft shopping ads through late 2025, after pulling out of Google’s.

Google Shopping ads delivered strong scale with 16% spend growth and 17% click growth, even as CPCs fell 1% amid reduced competitive pressure.

Performance Max accounted for 62% of Google Shopping spend and 61% of sales, with advertisers navigating evolving inventory to maintain near-parity ROAS versus standard Shopping campaigns.

Advertisers are seeing some relief on brand keyword CPCs in Google text ads. After a steep 19% year-over-year jump in Q1 2025, brand CPC growth eased to just 2% by Q4. Non-brand CPCs remained relatively steady, increasing by about 3% in Q1 and Q2 before dipping slightly and ending Q4 down 1%.

Paid Social: Faster Impression Growth as CPMs Ease

Meta Ads impressions are rising, Instagram CPM growth is under 10%, and Reels ads have doubled their impression share on Facebook

Meta ad impressions rose 17% YoY, the fastest growth rate since Q3 2023, while CPMs fell 7%, helping advertisers scale reach efficiently during the holidays. Ad spend growth, however, eased from 14% to 9% due to tougher year-over-year comparisons, even as two-year growth remained broadly stable.

Facebook spend grew 3%, supported by 19% impression growth, as CPMs dropped sharply by 13% due to expanding Reels inventory. Instagram CPM growth slowed to 8%, the lowest since Q1 2024, as Reels surpassed Feed to become the largest source of ad impressions.

While retail spend on Meta’s Advantage+ sales campaigns has dipped from the 38% seen in Q1 2025, they remain vital for retailers. In Q4, ASC still captured 27% of retail Meta spend, unchanged from Q3.

Pinterest ad spend rose 37% year over year in Q4, driven by higher impressions (+24%) and CPMs (+11%). Strong growth continued throughout 2025, with quarterly spend up at least 32%, supported by the adoption of Pinterest’s AI-powered Performance+ tools.

Holiday Stability: Amazon and Walmart Lead the Way

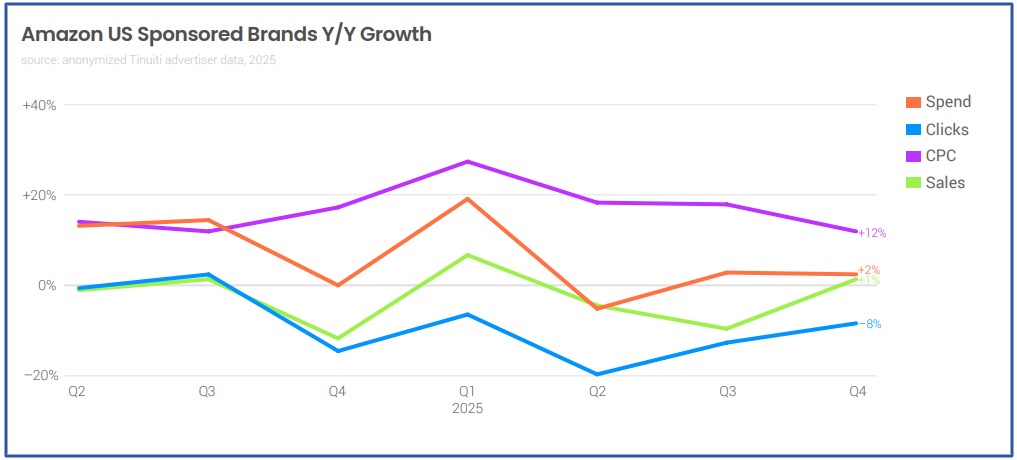

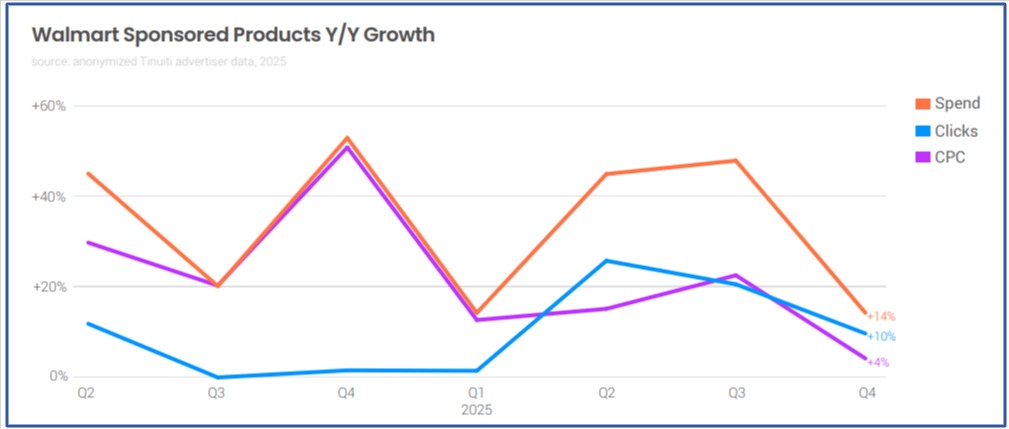

Amazon Sponsored Brands saw steady growth toward year-end, while Walmart Sponsored Products gained strong momentum in Q4

Amazon Sponsored Products clicks jumped 23% YoY, driving 22% spend growth, while CPCs declined 1%, extending a multi-quarter pricing softening trend. Advertisers slightly ramped up spending on Amazon Sponsored Brands—including Sponsored Brands video ads—up 2% year over year, as a 12% rise in cost per click made up for an 8% drop in clicks.

Investment in Amazon Sponsored Display has declined sharply, with Q4 2025 spend down 47% Y/Y and both clicks and CPC falling 27%. While Sponsored Display is becoming less central, overall display advertising on Amazon continues to grow as advertisers shift budgets to the Amazon DSP for premium inventory and audience targeting.

Walmart Sponsored Products spend increased 14%, with 10% click growth and just 4% CPC growth, marking the platform’s most efficient pricing trend since mid-2023.

While Walmart’s onsite inventory remains highly valued, many advertisers are using its self-serve display tools to reach audiences offsite. In Q4, offsite placements drove 60% of spend, while onsite inventory generated just 26% of impressions but captured 40% of spend due to higher CPMs.

Video & Display: YouTube and Streaming Scale Rapidly on Lower CPMs

Video and display ads drove strong efficiency gains in Q4 2025, with YouTube seeing higher impressions and lower CPMs due to increased Demand Gen adoption

Advertisers spent 13% more on YouTube in Q4 2025 compared to last year. While impressions surged by 38%, the average CPM declined by 18%, signalling broader reach at a lower cost.

In Q4 2025, Shorts ads accounted for nearly 21% of YouTube video ad spend, behind skippable in-stream ads at 55%. Most Shorts spend went to TV screens (49%), followed by mobile (26%), while Demand Gen campaigns allocated just 11% of spend to Shorts.

Google Demand Gen campaigns continued strong adoption, with 25% spend growth, 40% impression growth, and CPMs down 11%. Streaming video ad spend (excluding YouTube) grew 13%, as impressions rose 14% despite CPMs declining 1%.

Amazon Prime Video ad spend jumped 31% quarter-over-quarter and 127% year-over-year, emerging as one of the fastest-growing premium video channels.

Once again, click here to download the complete report.

Related Links

Stop the wasted ad spend. Get more conversions from the same ad budget.

Our customers save over $16 Million per year on Google and Amazon Ads.